Friday, May 27, 2011

Moving to Another Spot

It's moving day! I've decided to move this blog to another site. You can now read all of these posts and more on johnnycox.com. Hope to see you there!

Wednesday, April 20, 2011

We Have to Raise the Debt Ceiling Because Bush Lowered Taxes?

I constantly hear the president blaming the Bush tax cuts (and everything else besides his own actions) for our current deficits today. Is there any truth to that? The media will have you believe that the Bush tax cuts were mostly for the wealthy and that because of them, the rich aren’t paying their fair share. That sounds plausible, doesn’t it? Let’s examine a few facts first.

The Bush tax cuts were enacted in 2001 and 2003. Together they lowered the effective individual income tax rates for most taxpayers and were phased in over three years 2001, 2002 and 2003. Since 2003, the individual income taxes rates have remained the same, which consists of six tax brackets having rates of 10%, 15%, 25%, 28%, 33% and 35%. Before 2002, there were only 5 brackets, with the lowest being 15%.

So how did these tax cuts affect individuals? Well, if you had a summer job and earned $8,000 dollars in 2000, your tax rate was 15%. In 2009, it would have only been 10%. Your rate would have been reduced by 1/3.

Suppose you earn $30,000. In 2000 you paid 28% and in 2009 you only paid 15%. That’s almost cut in half (46%). For an $80,000/yr earner, the rate dropped from 31% to 25%. The table below shows some examples of how taxpayers at different income levels have benefited from the Bush tax cuts.

You should be able see from this table that the tax cuts weren’t just for the rich, they were for almost everyone. In fact, those making under $34,000 had the largest reductions percentage-wise.

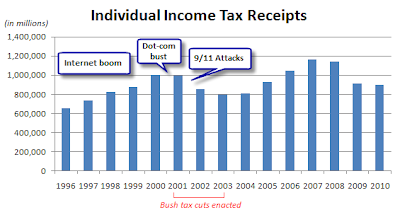

What was the purpose of the tax cuts anyway? The idea was that in 2000, the government had overtaxed Americans. In that year, the IRS collected more taxes than the government actually spent. What? How did that happen with a democrat (Clinton) in the white house? Aren’t democrats supposed to be big spenders? Well, I’d argue that the reason we had a surplus was two-fold. First, the republicans took control of the US House of Representative for the first time since 1953, which, in my opinion, curtailed spending growth. Second, and more importantly, income tax revenues were at an all time high due largely to the internet bubble of the late 1990’s. The economic impact of the Internet was tremendous. It created thousands of new companies and jobs, provided new markets for others, and gave individuals easier access to investment (online stock brokers), which flooded capital into the markets causing stocks to soar.

Much debate was given over what to do with the tax surplus for 2000. Bush and most republicans decided that since the tax money came from taxpayers in the first place, then they would give it back to them by gradually lowering the tax rates such that future tax collections would be on par with spending.

It was a sound plan, despite the controversy. But then a few unexpected things happened, which were not related to the tax cuts at all. The dot-com bubble burst. The investment fury into new technology companies lead to overvalued stock prices which ultimately collapsed. Many companies and investors went broke. The Nasdaq fell from a record high of $5,132 in March 2000 to just $1,720 a year later. Even today, the Nasdaq still hasn’t recovered at only $2,800.

As if the dot com bubble bursting wasn’t enough, something else happened. American was attacked on September 11, 2001. This also had a devastating impact on our economy. Ten days after the attack, the Dow Jones Industrial Average hit a 12 year low at $8,235 on September 21, 2001.

Ok, so our income tax collections were hit by three major factors in the first few years of the Bush term: the lower tax rates, the internet bubble, and the 9/11 attacks. In fact, with the economy slumping, the Bush tax cuts were accelerated. Originally, they were supposed to the phased in over a longer period but were enacted in full in 2003 due to the downturn in the economy. Why? Well, the idea behind this strategy is highly debated. As I understand it, the philosophy was that a lower tax burden would encourage businesses to invest (instead of paying higher taxes) and individuals would have more money to spend, thus creating more economic activity. In short, the result was to be more people paying tax on higher incomes, thus offsetting the reduced rates. If this were true, then our government would receive more tax, not less.

Did it work? Despite the dot com collapse and 9/11, yes it did. Huh? By 2006, our income receipts were MORE than they were in 2000, before the tax cuts. America had record setting tax years in 2006 and 2007. In fact, 2006, 2007 and 2008 all had higher income tax revenues than in 2000. But I thought Obama said the tax cuts were bad?

Did the Bush tax cuts favor the rich? If that was true, then wouldn’t it be fair to say that the rich are paying less now than they did before the tax cuts?

In 2000, the US population was 281,421,906. According to the IRS, only 37.4% of those people actually paid any income taxes at all. That’s right, 62.6% of all Americans didn’t pay ANY income taxes...zero. Of course, this number includes children, but still. So what about the 105 million people who did pay? Let’s call the top 1% of earners the “super-rich” as Obama likes to say. There were about 1 million people in this category, which was only about 0.37% of the total population. That group paid a whopping 1/3 of the total income taxes reported that year.

If you expand that group to the top 5%, let’s just call them “rich”. Now we’re talking about 2% of the total population. This group paid about half of the total taxes reported. That’s leaves the other 95% of taxpayers to pay the rest.

Now let’s look at the lower earners, say the bottom 50% of taxpayers. This accounted for about 81% of the total US population. This huge group only paid less than 8% of the total tax bill.

Ok, so that was in 2000. What about 2008, after the Bush tax cuts were in full effect? If these were so skewed towards rich people, shouldn’t these numbers be drastically different?

Let’s see. In 2008, the US population had grown by about 20 million to 301,621,157. The IRS reports that only 35.8% of Americans paid any income tax that year. That’s a smaller percentage than in 2000. The top 1% of those taxpayers (about 0.36% of the population) again paid about 1/3 of the total tax bill. That’s right; the “super rich” paid the same share as they did in 2000. What about the top 5%? In 2008, they paid… wait for it… 51%. Huh? Under the Bush tax cuts the richest 5% had to pay MORE? The Top 5% paid 50% in 2000 and 51% in 2008.

This can’t be right. Surely, somebody got screwed. How about the bottom 50%? Remember, the bottom 50% of taxpayers, represented 82% of the total population in 2008. The group again paid just under 8% of the bill, slightly smaller than they did in 2000. (7.9% vs. 7.6%)

Ok, so if the tax cuts aren’t to blame for the current deficits, what is? Well, something rather significant happened in 2008 (besides electing Obama). The nation had been experiencing a housing boom. By 2006, the average price of a home was more than double (124%) the price it was just ten years earlier. The cause of this boom is also controversial. Interest rates being too low, banks lending to risky borrowers with little or no down payment, and increased foreign investments are just some of the common causes being thrown about today. However, the eventual bust of this housing bubble has a much clearer culprit - defaults.

As the Federal Reserve Bank raised interest rates, people with adjustable mortgages could no longer afford their mortgage payments (if they could even afford them in the first place). Home foreclosures began to increase. This led to fewer buyers and more homes on the market, which caused home prices to drop. As folks witnessed their home equity dry up, many even became “under water,” which means home owners owed more on their home than it was worth. This triggered an even greater number of defaults and foreclosures, perpetuating the problem. With all of the foreclosures going on, lenders were in a panic. The falling home prices meant that their collateral for the loans no longer covered their risk. Credit markets froze. Banks stopped lending. This affected not only the housing market but everything else. Business couldn’t borrow money to expand or make capital improvements. Individual couldn’t borrow to buy new cars or make home improvements. Credit card rates skyrocketed. It was an economic Armageddon.

Get the picture? The crisis led to TARP (government loans to bail out the banks), and provided an excuse for the incoming president to open up the spending gates. After spending $787 billion in a “stimulus” package the first month in office, Obama and the democrat-led house and senate felt that our only solution was to pump loads of money into the economy with more bailouts, government rebates for buying new cars and houses, more government jobs (i.e. bigger government) and health care. All the while, blaming Bush and the republicans for letting it happen.

I’ll save my analysis of why this happened and who’s to blame for another post. But as a result, the stock market crashed. The Dow hit bottom at $6,626 in March of 2009, losing half of its value in less than 10 months. Investments soured, retirement savings vanished, and jobs were lost. The unemployment rate went from 4.5% in April 2008 to a high of 10% by January 2010 and has remained above 9% ever since. This is why our tax revenue dropped after 2008. Fewer people were working.

The Bush tax cuts were enacted in 2001 and 2003. Together they lowered the effective individual income tax rates for most taxpayers and were phased in over three years 2001, 2002 and 2003. Since 2003, the individual income taxes rates have remained the same, which consists of six tax brackets having rates of 10%, 15%, 25%, 28%, 33% and 35%. Before 2002, there were only 5 brackets, with the lowest being 15%.

So how did these tax cuts affect individuals? Well, if you had a summer job and earned $8,000 dollars in 2000, your tax rate was 15%. In 2009, it would have only been 10%. Your rate would have been reduced by 1/3.

Suppose you earn $30,000. In 2000 you paid 28% and in 2009 you only paid 15%. That’s almost cut in half (46%). For an $80,000/yr earner, the rate dropped from 31% to 25%. The table below shows some examples of how taxpayers at different income levels have benefited from the Bush tax cuts.

You should be able see from this table that the tax cuts weren’t just for the rich, they were for almost everyone. In fact, those making under $34,000 had the largest reductions percentage-wise.

What was the purpose of the tax cuts anyway? The idea was that in 2000, the government had overtaxed Americans. In that year, the IRS collected more taxes than the government actually spent. What? How did that happen with a democrat (Clinton) in the white house? Aren’t democrats supposed to be big spenders? Well, I’d argue that the reason we had a surplus was two-fold. First, the republicans took control of the US House of Representative for the first time since 1953, which, in my opinion, curtailed spending growth. Second, and more importantly, income tax revenues were at an all time high due largely to the internet bubble of the late 1990’s. The economic impact of the Internet was tremendous. It created thousands of new companies and jobs, provided new markets for others, and gave individuals easier access to investment (online stock brokers), which flooded capital into the markets causing stocks to soar.

Much debate was given over what to do with the tax surplus for 2000. Bush and most republicans decided that since the tax money came from taxpayers in the first place, then they would give it back to them by gradually lowering the tax rates such that future tax collections would be on par with spending.

It was a sound plan, despite the controversy. But then a few unexpected things happened, which were not related to the tax cuts at all. The dot-com bubble burst. The investment fury into new technology companies lead to overvalued stock prices which ultimately collapsed. Many companies and investors went broke. The Nasdaq fell from a record high of $5,132 in March 2000 to just $1,720 a year later. Even today, the Nasdaq still hasn’t recovered at only $2,800.

As if the dot com bubble bursting wasn’t enough, something else happened. American was attacked on September 11, 2001. This also had a devastating impact on our economy. Ten days after the attack, the Dow Jones Industrial Average hit a 12 year low at $8,235 on September 21, 2001.

Ok, so our income tax collections were hit by three major factors in the first few years of the Bush term: the lower tax rates, the internet bubble, and the 9/11 attacks. In fact, with the economy slumping, the Bush tax cuts were accelerated. Originally, they were supposed to the phased in over a longer period but were enacted in full in 2003 due to the downturn in the economy. Why? Well, the idea behind this strategy is highly debated. As I understand it, the philosophy was that a lower tax burden would encourage businesses to invest (instead of paying higher taxes) and individuals would have more money to spend, thus creating more economic activity. In short, the result was to be more people paying tax on higher incomes, thus offsetting the reduced rates. If this were true, then our government would receive more tax, not less.

Did it work? Despite the dot com collapse and 9/11, yes it did. Huh? By 2006, our income receipts were MORE than they were in 2000, before the tax cuts. America had record setting tax years in 2006 and 2007. In fact, 2006, 2007 and 2008 all had higher income tax revenues than in 2000. But I thought Obama said the tax cuts were bad?

Source: Table 2.1, Historical Tables, FY2012 Budget

Did the Bush tax cuts favor the rich? If that was true, then wouldn’t it be fair to say that the rich are paying less now than they did before the tax cuts?

In 2000, the US population was 281,421,906. According to the IRS, only 37.4% of those people actually paid any income taxes at all. That’s right, 62.6% of all Americans didn’t pay ANY income taxes...zero. Of course, this number includes children, but still. So what about the 105 million people who did pay? Let’s call the top 1% of earners the “super-rich” as Obama likes to say. There were about 1 million people in this category, which was only about 0.37% of the total population. That group paid a whopping 1/3 of the total income taxes reported that year.

If you expand that group to the top 5%, let’s just call them “rich”. Now we’re talking about 2% of the total population. This group paid about half of the total taxes reported. That’s leaves the other 95% of taxpayers to pay the rest.

Now let’s look at the lower earners, say the bottom 50% of taxpayers. This accounted for about 81% of the total US population. This huge group only paid less than 8% of the total tax bill.

Ok, so that was in 2000. What about 2008, after the Bush tax cuts were in full effect? If these were so skewed towards rich people, shouldn’t these numbers be drastically different?

Let’s see. In 2008, the US population had grown by about 20 million to 301,621,157. The IRS reports that only 35.8% of Americans paid any income tax that year. That’s a smaller percentage than in 2000. The top 1% of those taxpayers (about 0.36% of the population) again paid about 1/3 of the total tax bill. That’s right; the “super rich” paid the same share as they did in 2000. What about the top 5%? In 2008, they paid… wait for it… 51%. Huh? Under the Bush tax cuts the richest 5% had to pay MORE? The Top 5% paid 50% in 2000 and 51% in 2008.

This can’t be right. Surely, somebody got screwed. How about the bottom 50%? Remember, the bottom 50% of taxpayers, represented 82% of the total population in 2008. The group again paid just under 8% of the bill, slightly smaller than they did in 2000. (7.9% vs. 7.6%)

Source: IRS.gov Statistical Tables for 2000 and 2008

Ok, so if the tax cuts aren’t to blame for the current deficits, what is? Well, something rather significant happened in 2008 (besides electing Obama). The nation had been experiencing a housing boom. By 2006, the average price of a home was more than double (124%) the price it was just ten years earlier. The cause of this boom is also controversial. Interest rates being too low, banks lending to risky borrowers with little or no down payment, and increased foreign investments are just some of the common causes being thrown about today. However, the eventual bust of this housing bubble has a much clearer culprit - defaults.

As the Federal Reserve Bank raised interest rates, people with adjustable mortgages could no longer afford their mortgage payments (if they could even afford them in the first place). Home foreclosures began to increase. This led to fewer buyers and more homes on the market, which caused home prices to drop. As folks witnessed their home equity dry up, many even became “under water,” which means home owners owed more on their home than it was worth. This triggered an even greater number of defaults and foreclosures, perpetuating the problem. With all of the foreclosures going on, lenders were in a panic. The falling home prices meant that their collateral for the loans no longer covered their risk. Credit markets froze. Banks stopped lending. This affected not only the housing market but everything else. Business couldn’t borrow money to expand or make capital improvements. Individual couldn’t borrow to buy new cars or make home improvements. Credit card rates skyrocketed. It was an economic Armageddon.

Get the picture? The crisis led to TARP (government loans to bail out the banks), and provided an excuse for the incoming president to open up the spending gates. After spending $787 billion in a “stimulus” package the first month in office, Obama and the democrat-led house and senate felt that our only solution was to pump loads of money into the economy with more bailouts, government rebates for buying new cars and houses, more government jobs (i.e. bigger government) and health care. All the while, blaming Bush and the republicans for letting it happen.

I’ll save my analysis of why this happened and who’s to blame for another post. But as a result, the stock market crashed. The Dow hit bottom at $6,626 in March of 2009, losing half of its value in less than 10 months. Investments soured, retirement savings vanished, and jobs were lost. The unemployment rate went from 4.5% in April 2008 to a high of 10% by January 2010 and has remained above 9% ever since. This is why our tax revenue dropped after 2008. Fewer people were working.

Source: Table 1.1, Historical Tables, FY2012 Budget

Source: Tables 1.1 & 2.1, Historical Tables, FY2012 Budget

Where has all of this gotten us? Deep in debt. Our current debt around $14.3 trillion and is bumping against the current debt ceiling. The debt ceiling is the statutory limit authorized by Congress. This chart shows our growing national debt over the past 15 years and the red lines indicate the past times that the debt ceiling was raised. The debt is growing out of control.

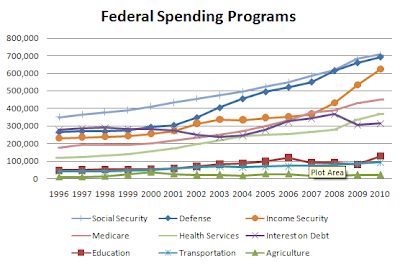

The real reason that we have huge deficits every year is because of spending. We spend too much. This is not a partisan problem; it has happened under both parties. Some may like to take credit for deficit reduction initiatives, but the guilty ones have both D’s and R’s after their names.

Source: Tables 1.1 & 2.1, Historical Tables, FY2012 Budget

The chart above shows our total individual income tax receipts (the green bars) compared to how much MORE money we borrowed (deficit) that same year (the red bars). As you can see, we have been borrowing more than we collected in income tax since 2009. That means that if ALL of the individual income tax rates were doubled (for everybody) to 20%, 30%, 50%, 56%, 66% and 70%, it STILL wouldn’t be enough to cover the deficit! And that’s assuming that those exorbitant rates wouldn’t crimple the economy any further (which they certainly would). In fact, the 2009 income rates would have to have been astronomical to cover our deficit that year (27%, 40%, 67%, 89%, 94%). Would you like to pay those rates? Would you like for your children or grandchildren to pay those rates? Because today’s deficits are simply future taxes.

The chart below shows an even more alarming view. Each bar represents the total amount of money that our federal government actually spent each year. The different colors within each bar show from where the government got the money. A portion of each budget came from several different taxes. The remaining amount (deficit) was borrowed which is shown in red.

Source: Tables 1.1 & 2.1, Historical Tables, FY2012 Budget

What are we spending all of this money on? Well, spending levels have increased in almost every category. Have a look.

Source: Table 3.1, Historical Tables, FY2012 Budget

Where has all of this gotten us? Deep in debt. Our current debt around $14.3 trillion and is bumping against the current debt ceiling. The debt ceiling is the statutory limit authorized by Congress. This chart shows our growing national debt over the past 15 years and the red lines indicate the past times that the debt ceiling was raised. The debt is growing out of control.

Source: Table 7.1, Historical Tables, FY2012 Budget

Now the debate is whether or not we should raise the debt limit yet again. But why do we even have one at all? I mean, if everyone in Congress says that we absolutely MUST raise it this month – I ask, raise it to what? $15 trillion? 18 trillion? And when we borrow and spend our way to that limit, is the consensus going to be that we MUST raise it again to avoid a government default, world-wide financial chaos, and another depression? If the answer is always going to be that we MUST raise the debt limit whenever we reach it, then what in the World is the dang thing for? When does it stop?

Failing to raise the debt limit should not be viewed as an empty threat. That’s because world-wide collapse is not hinging on our default, but on our reckless fiscal policy. Once “tax and spend” liberals run out of our tax dollars, they become “borrow and spend” liberals. All of that borrowing is simply future taxes…taxes on our children. Where is the outrage on having trillion dollar deficits when all of the income tax paid in the U.S in a year is barely over a $1 trillion.

Raising the limit without meaningful fiscal reform only kicks the can down the road and digs the hole deeper for our children. Our generation allowed this to happen. It’s our generation that should face the consequences.

The World needs to know that we are serious about getting our fiscal house in order. We’ve gone a 10 year bender, and now we are surprised that we’re broke and have a hangover. If Obama feels the need to apologize for America, then he should apologize for that! Let’s just hope we didn’t “drunk call” anyone.

Tuesday, April 12, 2011

I Totally Agree With Obama

“Mr. President, I rise today to talk about America's debt problem. The fact that we are here today to debate raising America's debt limit is a sign of leadership failure. It is a sign that the U.S. Government can't pay its own bills. It is a sign that we now depend on ongoing financial assistance from foreign countries to finance our Government's reckless fiscal policies. [..] If Washington were serious about honest tax relief in this country, we would see an effort to reduce our national debt by returning to responsible fiscal policies.[..] Increasing America's debt weakens us domestically and internationally. Leadership means that ``the buck stops here.'' Instead, Washington is shifting the burden of bad choices today onto the backs of our children and grandchildren. America has a debt problem and a failure of leadership. Americans deserve better.”

– Senator Barrack Obama (D-IL), March 16, 2006.

Wow, what a difference five years makes! The excerpt above was taken from then Senator Barrack Obama’s Senate speech when the question of raising America’s debt limit was being debated a few years ago. I couldn’t have said it better myself. Where’s your fiscal conscience now, Mr. President?

The entire speech is quoted below along with a link to the Congressional Record as published online.

The 2006 Congressional Record, Page S2237 (March 16,2006) (link)

Mr. President, I rise today to talk about America's debt problem.

The fact that we are here today to debate raising America's debt limit is a sign of leadership failure. It is a sign that the U.S. Government can't pay its own bills. It is a sign that we now depend on ongoing financial assistance from foreign countries to finance our Government's reckless fiscal policies.

Over the past 5 years, our federal debt has increased by $3.5 trillion to $8.6 trillion. That is ``trillion'' with a ``T.'' That is money that we have borrowed from the Social Security trust fund, borrowed from China and Japan, borrowed from American taxpayers. And over the next 5 years, between now and 2011, the President's budget will increase the debt by almost another $3.5 trillion.

Numbers that large are sometimes hard to understand. Some people may wonder why they matter. Here is why: This year, the Federal Government will spend $220 billion on interest. That is more money to pay interest on our national debt than we'll spend on Medicaid and the State Children's Health Insurance Program. That is more money to pay interest on our debt this year than we will spend on education, homeland security, transportation, and veterans benefits combined. It is more money in one year than we are likely to spend to rebuild the devastated gulf coast in a way that honors the best of America.

And the cost of our debt is one of the fastest growing expenses in the Federal budget. This rising debt is a hidden domestic enemy, robbing our cities and States of critical investments in infrastructure like bridges, ports, and levees; robbing our families and our children of critical investments in education and health care reform; robbing our seniors of the retirement and health security they have counted on.

Every dollar we pay in interest is a dollar that is not going to investment in America's priorities. Instead, interest payments are a significant tax on all Americans--a debt tax that Washington doesn't want to talk about. If Washington were serious about honest tax relief in this country, we would see an effort to reduce our national debt by returning to responsible fiscal policies.

But we are not doing that. Despite repeated efforts by Senators Conrad and Feingold, the Senate continues to reject a return to the commonsense Pay-go rules that used to apply. Previously, Pay-go rules applied both to increases in mandatory spending and to tax cuts. The Senate had to abide by the commonsense budgeting principle of balancing expenses and revenues. Unfortunately, the principle was abandoned, and now the demands of budget discipline apply only to spending.

As a result, tax breaks have not been paid for by reductions in Federal spending, and thus the only way to pay for them has been to increase our deficit to historically high levels and borrow more and more money. Now we have to pay for those tax breaks plus the cost of borrowing for them. Instead of reducing the deficit, as some people claimed, the fiscal policies of this administration and its allies in Congress will add more than $600 million in debt for each of the next 5 years. That is why I will once again cosponsor the Pay-go amendment and continue to hope that my colleagues will return to a smart rule that has worked in the past and can work again.

Our debt also matters internationally. My friend, the ranking member of the Senate Budget Committee, likes to remind us that it took 42 Presidents 224 years to run up only $1 trillion of foreign-held debt. This administration did more than that in just 5 years. Now, there is nothing wrong with borrowing from foreign countries. But we must remember that the more we depend on foreign nations to lend us money, the more our economic security is tied to the whims of foreign leaders whose interests might not be aligned with ours.

Increasing America's debt weakens us domestically and internationally. Leadership means that ``the buck stops here.'' Instead, Washington is shifting the burden of bad choices today onto the backs of our children and grandchildren. America has a debt problem and a failure of leadership. Americans deserve better.

I therefore intend to oppose the effort to increase America's debt limit.

- Senator Barrack Obama (D-IL)

– Senator Barrack Obama (D-IL), March 16, 2006.

Wow, what a difference five years makes! The excerpt above was taken from then Senator Barrack Obama’s Senate speech when the question of raising America’s debt limit was being debated a few years ago. I couldn’t have said it better myself. Where’s your fiscal conscience now, Mr. President?

The entire speech is quoted below along with a link to the Congressional Record as published online.

The 2006 Congressional Record, Page S2237 (March 16,2006) (link)

Mr. President, I rise today to talk about America's debt problem.

The fact that we are here today to debate raising America's debt limit is a sign of leadership failure. It is a sign that the U.S. Government can't pay its own bills. It is a sign that we now depend on ongoing financial assistance from foreign countries to finance our Government's reckless fiscal policies.

Over the past 5 years, our federal debt has increased by $3.5 trillion to $8.6 trillion. That is ``trillion'' with a ``T.'' That is money that we have borrowed from the Social Security trust fund, borrowed from China and Japan, borrowed from American taxpayers. And over the next 5 years, between now and 2011, the President's budget will increase the debt by almost another $3.5 trillion.

Numbers that large are sometimes hard to understand. Some people may wonder why they matter. Here is why: This year, the Federal Government will spend $220 billion on interest. That is more money to pay interest on our national debt than we'll spend on Medicaid and the State Children's Health Insurance Program. That is more money to pay interest on our debt this year than we will spend on education, homeland security, transportation, and veterans benefits combined. It is more money in one year than we are likely to spend to rebuild the devastated gulf coast in a way that honors the best of America.

And the cost of our debt is one of the fastest growing expenses in the Federal budget. This rising debt is a hidden domestic enemy, robbing our cities and States of critical investments in infrastructure like bridges, ports, and levees; robbing our families and our children of critical investments in education and health care reform; robbing our seniors of the retirement and health security they have counted on.

Every dollar we pay in interest is a dollar that is not going to investment in America's priorities. Instead, interest payments are a significant tax on all Americans--a debt tax that Washington doesn't want to talk about. If Washington were serious about honest tax relief in this country, we would see an effort to reduce our national debt by returning to responsible fiscal policies.

But we are not doing that. Despite repeated efforts by Senators Conrad and Feingold, the Senate continues to reject a return to the commonsense Pay-go rules that used to apply. Previously, Pay-go rules applied both to increases in mandatory spending and to tax cuts. The Senate had to abide by the commonsense budgeting principle of balancing expenses and revenues. Unfortunately, the principle was abandoned, and now the demands of budget discipline apply only to spending.

As a result, tax breaks have not been paid for by reductions in Federal spending, and thus the only way to pay for them has been to increase our deficit to historically high levels and borrow more and more money. Now we have to pay for those tax breaks plus the cost of borrowing for them. Instead of reducing the deficit, as some people claimed, the fiscal policies of this administration and its allies in Congress will add more than $600 million in debt for each of the next 5 years. That is why I will once again cosponsor the Pay-go amendment and continue to hope that my colleagues will return to a smart rule that has worked in the past and can work again.

Our debt also matters internationally. My friend, the ranking member of the Senate Budget Committee, likes to remind us that it took 42 Presidents 224 years to run up only $1 trillion of foreign-held debt. This administration did more than that in just 5 years. Now, there is nothing wrong with borrowing from foreign countries. But we must remember that the more we depend on foreign nations to lend us money, the more our economic security is tied to the whims of foreign leaders whose interests might not be aligned with ours.

Increasing America's debt weakens us domestically and internationally. Leadership means that ``the buck stops here.'' Instead, Washington is shifting the burden of bad choices today onto the backs of our children and grandchildren. America has a debt problem and a failure of leadership. Americans deserve better.

I therefore intend to oppose the effort to increase America's debt limit.

- Senator Barrack Obama (D-IL)

Thursday, September 30, 2010

The Hard Core of Freedom

While doing some internet research (for a discussion on Facebook, no less), I stumbled across this article from the Daily Oklahoman published on December 9, 1951. I felt it was worth passing along. However, the citation of one quote in the article to Alexander Tytler (1747-1813) cannot be verified.

This is the Hard Core of Freedom

By ELMER T. PETERSON

A card without identification came along with a letter to this desk a few days ago. It read:

“There is no end to the good a man can do if he does not care who gets the credit."

This sentiment has a vital drive when applied to human relations, but if you will follow it to its logical conclusion in the field of government, you will find that it constitutes the inner essence of free democracy as well. A civic leader once said to the writer, about 25 years ago:

"If a man goes into civic work because he expects to get credit for it, or political profit, or anything else of material value, he should quit before it gets too late, because he is practically sure to be disappointed and disillusioned. If he doesn't get a real thrill out of doing good in the world, sufficient to pay him, he has missed the point of all civic activity."

Friendship and love of parents for children are the first and most primitive evidences of the Christian doctrine, "love thy neighbor," and the corollary is the Golden Rule. This corollary clearly points the two-way nature of the original doctrine and it helps human beings to understand why helpfulness can bring reciprocal benefit to the doer of good deeds, even though the doer does not demand or even expect such benefit.

Out of the mutual nature of neighborliness comes the pure meaning of free democracy. Cooperation, in its best sense, as suggested in this column a week ago, cannot be compulsory. The moment it is made into a compulsory mechanism, it loses its true meaning and becomes a form of despotism—a totalitarian socialism, in which public welfare is produced by force and not by operation of conscience.

The difference between free democracy and socialism is that free democracy carries over into the field of government the voluntary will do good by free choice, where as socialism leaves the citizen no choice. He helps his neighbor—or else!

The best member of free democracy is one who doesn't care who gets the credit for good deeds. He gets all the pay he needs out of his conscience—the inner satisfaction of knowing that "he has done what he could."

It is becoming more and more obvious every day that the mere form of democracy is not what brings blessed government. It is the substance that counts. That substance consists of the sum of individual consciences, working for the mutual good of all. A form of democracy can be just as corrupt as the worst kind of despotism if the members of that formal democracy are actuated only by selfishness and the determination to get all possible money out of the government" or Neighbor Taxpayer.

Two centuries ago a somewhat obscure Scotsman named Tytler made this profound observation:

"A democracy cannot exist as a permanent form of government. It can only exist until the majority discovers it can vote itself largess out of the public treasury. After that, the majority always voles for the candidate promising the most benefits with the result the democracy collapses because of the loose fiscal policy ensuing, always to be followed by a dictatorship, then a monarchy."

This ought to be a warning sign, of the times, for never before in this nation has there been such temptation to use the formal mechanism of democracy as a means for gratifying the selfish designs of the individual citizen. This applies not only to the corrupt high official who sells influence or conspires with crooks to steal money from the public. It applies, likewise, to the individual voter who seeks to profit personally by laying a heavier burden on his neighbor, through subsidies and other government gifts.

The hard core of freedom is the unselfish spirit of the citizen. Democracy cannot live long without this agency of conscience. Unselfish motivation in politics is much more than a gesture of good morality. It is a practical factor without which democracy cannot exist. In the long run nothing else will work.

This is the Hard Core of Freedom

By ELMER T. PETERSON

A card without identification came along with a letter to this desk a few days ago. It read:

“There is no end to the good a man can do if he does not care who gets the credit."

This sentiment has a vital drive when applied to human relations, but if you will follow it to its logical conclusion in the field of government, you will find that it constitutes the inner essence of free democracy as well. A civic leader once said to the writer, about 25 years ago:

"If a man goes into civic work because he expects to get credit for it, or political profit, or anything else of material value, he should quit before it gets too late, because he is practically sure to be disappointed and disillusioned. If he doesn't get a real thrill out of doing good in the world, sufficient to pay him, he has missed the point of all civic activity."

Friendship and love of parents for children are the first and most primitive evidences of the Christian doctrine, "love thy neighbor," and the corollary is the Golden Rule. This corollary clearly points the two-way nature of the original doctrine and it helps human beings to understand why helpfulness can bring reciprocal benefit to the doer of good deeds, even though the doer does not demand or even expect such benefit.

Out of the mutual nature of neighborliness comes the pure meaning of free democracy. Cooperation, in its best sense, as suggested in this column a week ago, cannot be compulsory. The moment it is made into a compulsory mechanism, it loses its true meaning and becomes a form of despotism—a totalitarian socialism, in which public welfare is produced by force and not by operation of conscience.

The difference between free democracy and socialism is that free democracy carries over into the field of government the voluntary will do good by free choice, where as socialism leaves the citizen no choice. He helps his neighbor—or else!

The best member of free democracy is one who doesn't care who gets the credit for good deeds. He gets all the pay he needs out of his conscience—the inner satisfaction of knowing that "he has done what he could."

It is becoming more and more obvious every day that the mere form of democracy is not what brings blessed government. It is the substance that counts. That substance consists of the sum of individual consciences, working for the mutual good of all. A form of democracy can be just as corrupt as the worst kind of despotism if the members of that formal democracy are actuated only by selfishness and the determination to get all possible money out of the government" or Neighbor Taxpayer.

Two centuries ago a somewhat obscure Scotsman named Tytler made this profound observation:

"A democracy cannot exist as a permanent form of government. It can only exist until the majority discovers it can vote itself largess out of the public treasury. After that, the majority always voles for the candidate promising the most benefits with the result the democracy collapses because of the loose fiscal policy ensuing, always to be followed by a dictatorship, then a monarchy."

This ought to be a warning sign, of the times, for never before in this nation has there been such temptation to use the formal mechanism of democracy as a means for gratifying the selfish designs of the individual citizen. This applies not only to the corrupt high official who sells influence or conspires with crooks to steal money from the public. It applies, likewise, to the individual voter who seeks to profit personally by laying a heavier burden on his neighbor, through subsidies and other government gifts.

The hard core of freedom is the unselfish spirit of the citizen. Democracy cannot live long without this agency of conscience. Unselfish motivation in politics is much more than a gesture of good morality. It is a practical factor without which democracy cannot exist. In the long run nothing else will work.

Sunday, September 19, 2010

Looking Up in Marion County, SC

In 2009, the average SAT score for students in Marion School District One in South Carolina increased by 150 points or 11.5%. But before we break into a round of high-fives, let’s have a closer look. This improvement managed to earn Marion County the rank of 36th in the state. South Carolina has 46 counties, and Marion is 36th. This stat lets a little bit of air out of the balloon, but at least we are improving. We don’t have that far to go, right? Well, first consider that nationwide, our state is almost DEAD LAST in SAT scores. That’s right – out of 50 states, South Carolina is number 49 - the bottom of the barrel. Our county is 36th in a state that is 49th. If Marion County were a NCAA Division 1A football team, we could be about on par with West Kentucky in the Sun Belt Conference. In other words, don’t expect many pro scouts to be hanging around.

On a unrelated (or related) note, there are six different ways that the Department of Labor calculates the unemployment rate. They are designated U-1 through U-6. In all six categories, South Carolina ranks no better than 46th in unemployment in the country. We aren’t exactly last in any category, but we are 48th in two and 49th in one. (Thank you, Michigan.) Can you guess where Marion County ranks in unemployment within the state? Drum roll… DEAD LAST! Marion County has the highest unemployment in a state that has the highest (almost) unemployment in the country. Of course, it’s been this way for 10 years –but what else is new?

These are just two facts about our state and county. I suppose that I could dig around to find some other interesting data on poverty, crime, government assistance, child support delinquencies and the like; but who likes to beat a man while he’s down?

The question is - are these two statistics somehow related? Could it be that businesses don’t want to come to Marion County because we are just a bunch of dummies? Well, that may be a larger part of their strategy than we’d like to believe. Despite our beautiful town, its many trees (at least the ones that Progress Energy hasn’t mutilated yet), rich historical heritage, abundant land, vacant real estate, decent infrastructure and apparently a large percentage of the population ready and willing to go to work – companies stay away from us like the plague. Why?

That's the question that we should be asking ourselves: “Why is this the case and how can we fix it?” On the other hand, the question that we should be asking our students (and our idle workforce) is, “If you went to the store and bought three candy bars that cost $1 each, how much change should you expect back from a $5 bill if the sales tax rate is 10%?” If you don’t get an answer to the second question without the help of some electronic device, then perhaps you already have the answer to the first question.

On a unrelated (or related) note, there are six different ways that the Department of Labor calculates the unemployment rate. They are designated U-1 through U-6. In all six categories, South Carolina ranks no better than 46th in unemployment in the country. We aren’t exactly last in any category, but we are 48th in two and 49th in one. (Thank you, Michigan.) Can you guess where Marion County ranks in unemployment within the state? Drum roll… DEAD LAST! Marion County has the highest unemployment in a state that has the highest (almost) unemployment in the country. Of course, it’s been this way for 10 years –but what else is new?

These are just two facts about our state and county. I suppose that I could dig around to find some other interesting data on poverty, crime, government assistance, child support delinquencies and the like; but who likes to beat a man while he’s down?

The question is - are these two statistics somehow related? Could it be that businesses don’t want to come to Marion County because we are just a bunch of dummies? Well, that may be a larger part of their strategy than we’d like to believe. Despite our beautiful town, its many trees (at least the ones that Progress Energy hasn’t mutilated yet), rich historical heritage, abundant land, vacant real estate, decent infrastructure and apparently a large percentage of the population ready and willing to go to work – companies stay away from us like the plague. Why?

That's the question that we should be asking ourselves: “Why is this the case and how can we fix it?” On the other hand, the question that we should be asking our students (and our idle workforce) is, “If you went to the store and bought three candy bars that cost $1 each, how much change should you expect back from a $5 bill if the sales tax rate is 10%?” If you don’t get an answer to the second question without the help of some electronic device, then perhaps you already have the answer to the first question.

Sunday, September 12, 2010

Is Our Generation Relevant?

Is our generation relevant? Looking back over my life so far, I struggle to find any significant contributions or events that occurred during my lifetime that have truly shaped our country. It seems like all of the important stuff happened before I even got here. The Civil Rights Movement, World War II, the Great Depression, the American Civil War, and the American Revolution – all of these profoundly impacted this great nation that we call home. But what have we done lately?

One could argue that since I was born, in 1965, America has fought in Vietnam, Kuwait, Afghanistan and Iraq – and that these are certainly significant events. Actually, I was just a baby during the Vietnam War and have only vague memories of it – mostly towards the end of US involvement in the mid 70s. Not to diminish the huge sacrifices made and the service of our armed forces, these wars somehow paled in comparison to earlier wars in terms of how they impacted our nation's development or American life in general.

I'll admit that we have seen the fall of the Soviet Union, bringing an end to the Cold War - oh yeah, and men on the moon! What else, the Internet? I'm sorry, but I can't help but feel that my generation has lived on the spoils of those that came before us, all the while, doing little to earn or even preserve it. Or perhaps, our turn has yet to come.

Let me be totally honest with you. I started writing this article almost 8 months ago but set it aside because I didn't know where I was going with it. It was only today that I realized that I already know the answer. Until recently, our generation hasn't really been relevant all that much - but finally, the relevance of our generation is at hand. I believe that we are once again at a perilous juncture in our nation's history. Our system of government, and thus our cherished freedoms of which it was designed to protect, is under attack. But this time it's not England or Germany - it's a far more formidable enemy. And what's more shocking is that many of us are completely oblivious to this threat. That's because this enemy doesn't wear red coats or swastikas - they look just like you and me. They live right next door, go to your schools, work in your workplace, some you even call friends. Some don't even know themselves that they are soldiers in an army that is set on a path to destroy America.

The enemy is the Progressive. The Progressives think that government knows best and that more and more government is the solution to all problems. In all that you hear in this election year and certainly in 2012, there is one fundamental question that is the basis for most of the controversy between the parties. It is the question of Big Government vs. Limited Government. The Progressives want a big government, which is the complete antithesis of the founding principles of our country. A limited central government is the basic premise of the U.S. Constitution and is absolutely necessary to guarantee the protection of our liberties and freedoms.

When was the last time that you read the US Constitution? For most people the answer would be somewhere around the 10th grade. I can remember having to memorize the Bill of Rights, a handful of dates, and the names of some people who had something to do with the whole thing. But, unfortunately, I can't say that I remembered much of it. I guess we all had different priorities back then. Now that I'm much older, I think that I would really appreciate most of those things now, if only they were not taught, memorized, and then soon forgotten. Maybe there should be some sort of a condensed high school refresher that everyone should take around age 30.

If you haven't read the Constitution as an adult, please read it here. In a nutshell, the document grants the federal government exactly 17 specific powers (called the enumerated powers) - no more, no less. All other powers are reserved for the states, except those expressly prohibited by the Constitution. This is by careful design to prevent the government from becoming too powerful, which is why we fought for our independence in the first place. Progressives fail to see the logic in this.

The Progressives sit on both sides of the fence (Democrat and Republican). In their defense, most Progressives honestly feel that there is a just and moral rationale to their cause. However, their policies and short-sighted "solutions" have steadily been growing our government and gradually eroding the basic underpinning that is uniquely American.

The challenge facing our generation is the restoration of this nation back to its founding principles and to renew our faith in God. This is our Iwo Jima, it's our Bunker Hill. For ours is no longer the lost generation, but the last generation. We are the re-founders!

"I hope to see our happy country restored to its former peace and happiness, and once more redeemed from tyranny and despotism, which, I fear, we are on the very brink of. We see the whole country in commotion: and for what? Because, gentlemen, the true friends of liberty see the laws and constitution blotted out from the heads and hearts of the people's leaders: and their requests for relief are treated with scorn and contempt. It has been decided by a majority of Congress that [the president] shall be the Government, and that his will shall be the law of the land. He takes the responsibility, and vetoes any bill that does not meet his approbation. He takes the responsibility and seizes the treasury, and removes it from where the laws had placed it; and now, holding purse and sword, has bid defiance to the Congress and to the nation."

- Congressman David (Davy) Crockett, 1834

Below are a few links to some rather enlightening videos of Judge Andrew Napolitano discussing the role of the federal government. Please take the time to watch some of these.

Constitution For Dummies Part 1

Constitution For Dummies Part 2

Constitution For Dummies Part 3

Constitution For Dummies Part 4

The Patriot Act Part 1

The Patriot Act Part 2

The Patriot Act Part 3

The Patriot Act Q&A Part 1

The Patriot Act Q&A Part 2

Texas Secession

Tuesday, July 27, 2010

Subscribe to:

Posts (Atom)